What is a Wyoming Quitclaim Deed?

A Wyoming Quitclaim Deed is a legal document that allows a property owner to transfer their interest in real estate to another party. This type of deed does not guarantee that the property title is free of claims or encumbrances. Instead, it conveys whatever interest the grantor has at the time of the transfer, if any. It is often used in situations such as transferring property between family members or in divorce settlements.

How is a Quitclaim Deed different from a Warranty Deed?

The primary difference between a Quitclaim Deed and a Warranty Deed lies in the level of protection offered to the grantee. A Warranty Deed provides assurances that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed offers no such guarantees. The grantee receives only the interest the grantor possesses, which may be limited or nonexistent.

What information is required on a Wyoming Quitclaim Deed?

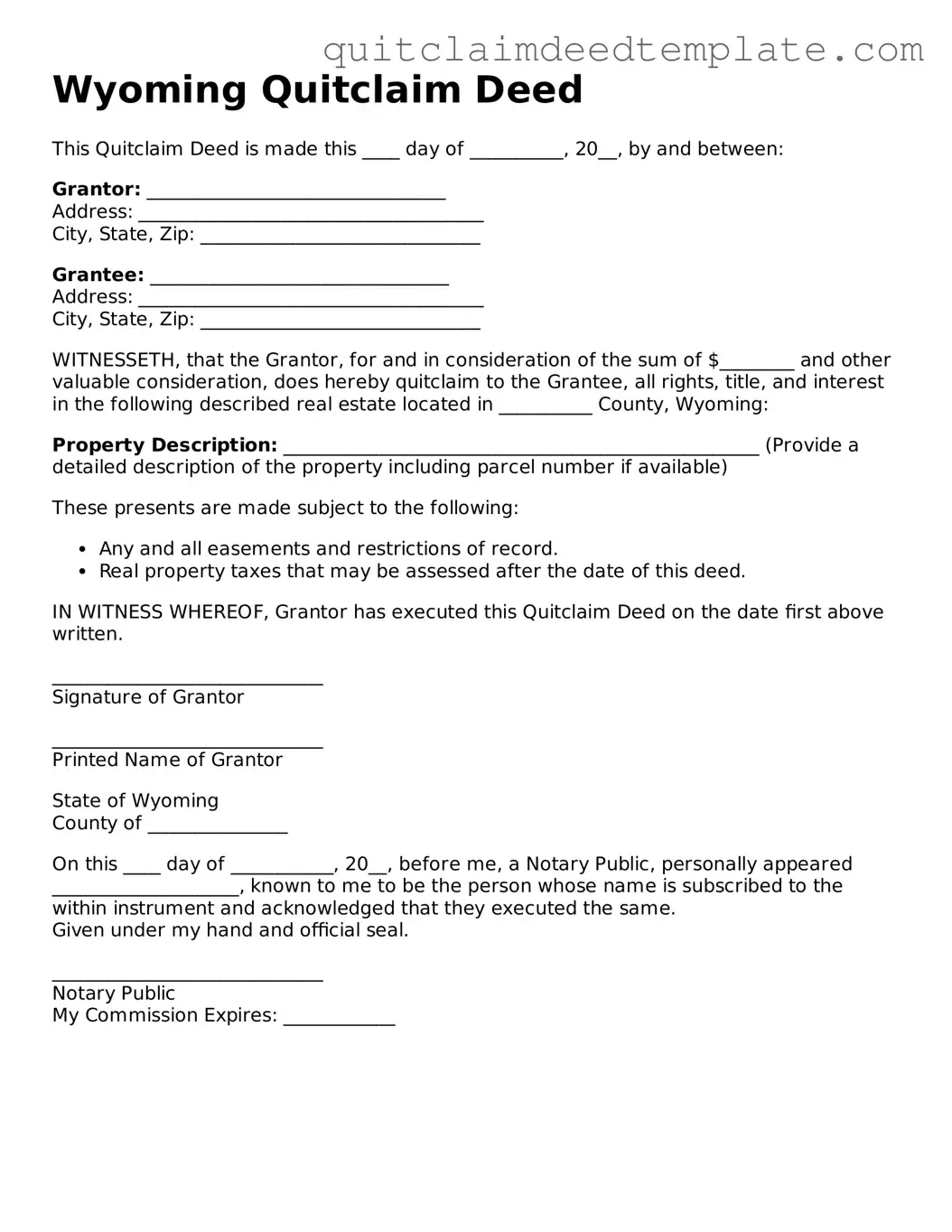

A Wyoming Quitclaim Deed must include specific information to be valid. This includes the names of the grantor and grantee, a legal description of the property, the date of the transfer, and the signature of the grantor. It is also advisable to include a notary acknowledgment to ensure the document is recognized by the state.

Is a Quitclaim Deed legally binding in Wyoming?

Yes, a Quitclaim Deed is legally binding in Wyoming once it is properly executed and recorded with the county clerk’s office. The recording provides public notice of the transfer and protects the rights of the grantee. However, the effectiveness of the deed is contingent upon the grantor having an interest in the property at the time of the transfer.

Do I need an attorney to prepare a Quitclaim Deed in Wyoming?

Can a Quitclaim Deed be used to transfer property to a trust?

Yes, a Quitclaim Deed can be used to transfer property into a trust. This process is often utilized in estate planning to facilitate the management and distribution of assets. When transferring property to a trust, it is essential to ensure that the trust is properly established and that the deed reflects the trust's name as the grantee.

What are the tax implications of using a Quitclaim Deed?

Generally, transferring property via a Quitclaim Deed may not trigger immediate tax consequences, but it is essential to consider potential implications. Property transfers can affect property taxes, and if the transfer involves a sale, capital gains taxes may apply. It is advisable to consult a tax professional to understand the specific tax implications based on individual circumstances.

How do I record a Quitclaim Deed in Wyoming?

To record a Quitclaim Deed in Wyoming, the completed deed must be submitted to the county clerk’s office in the county where the property is located. There may be a recording fee associated with this process. Once recorded, the deed becomes part of the public record, ensuring that the transfer is legally recognized.

Can a Quitclaim Deed be revoked?

A Quitclaim Deed cannot be revoked once it has been executed and recorded. The transfer of property is final. However, if both parties agree, a new deed can be executed to reverse the transfer or to clarify ownership. Legal advice may be necessary to navigate this process effectively.

What happens if the grantor has no interest in the property?

If the grantor has no interest in the property at the time of the transfer, the Quitclaim Deed will still be valid but will not convey any ownership rights to the grantee. The grantee will receive nothing, and the deed will serve as a formal acknowledgment of the grantor's lack of interest. This situation underscores the importance of verifying property ownership before executing a Quitclaim Deed.