What is a Quitclaim Deed in Wisconsin?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees. In Wisconsin, this type of deed is often used between family members or in situations where the parties know each other well. It allows the grantor to relinquish any claim to the property, but it does not assure the grantee of a clear title.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in various situations, such as transferring property between family members, adding or removing a spouse from the title after marriage or divorce, or transferring property into a trust. It is important to remember that this deed does not guarantee that the property is free from liens or other claims.

How do I complete a Quitclaim Deed in Wisconsin?

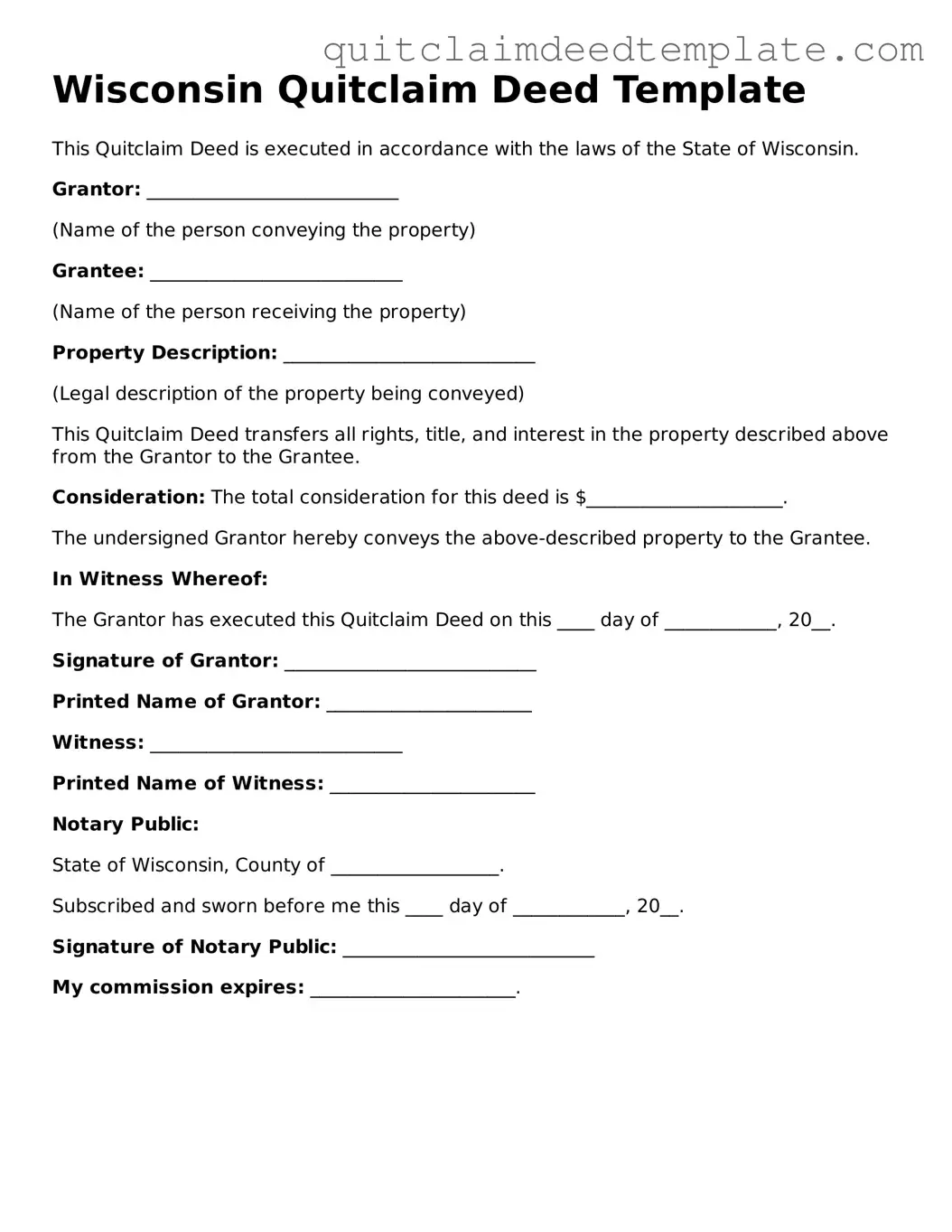

To complete a Quitclaim Deed, you will need to gather the necessary information, including the names of the grantor and grantee, a legal description of the property, and the date of the transfer. The document should be signed in front of a notary public. After signing, it must be filed with the county register of deeds to be legally effective.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed simply transfers whatever interest the grantor has in the property, without any assurances about the title.

Are there any fees associated with filing a Quitclaim Deed in Wisconsin?

Yes, there are typically fees associated with filing a Quitclaim Deed in Wisconsin. These fees vary by county and may include recording fees. It's advisable to check with your local register of deeds office for the exact amount and any additional costs that may apply.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked. However, the parties involved may agree to a new deed that reverses the transfer. It is important to consult with a legal professional if you need to change the ownership status of the property after a Quitclaim Deed has been executed.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is highly recommended. An attorney can ensure that the document is completed correctly and complies with state laws. This can help avoid potential issues in the future regarding property ownership or title disputes.

What happens if the Quitclaim Deed is not recorded?

If a Quitclaim Deed is not recorded, the transfer of ownership may not be recognized by third parties, such as lenders or potential buyers. Recording the deed provides public notice of the ownership change and protects the grantee's interest in the property. It is crucial to file the deed with the appropriate county office to ensure that the transfer is legally recognized.

Can I use a Quitclaim Deed to transfer property to myself?

Yes, you can use a Quitclaim Deed to transfer property to yourself, often referred to as a self-deed. This may be done for various reasons, such as changing the title from an individual name to a trust. However, it is advisable to consult with a legal professional to ensure that the transfer is executed correctly and serves your intended purpose.