What is a Quitclaim Deed in New Mexico?

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees. In New Mexico, this means that the grantor (the person transferring the property) relinquishes any claim they may have to the property, but they do not guarantee that they hold clear title. This type of deed is often used among family members or in situations where the parties know each other well.

Why would someone use a Quitclaim Deed?

People typically use a Quitclaim Deed for several reasons. It is often employed in divorce settlements, to add or remove a spouse from a property title, or to transfer property between family members. Additionally, it can be useful in situations where the parties are aware of the property’s condition and history, making the lack of warranties less of a concern.

What information is required on a Quitclaim Deed in New Mexico?

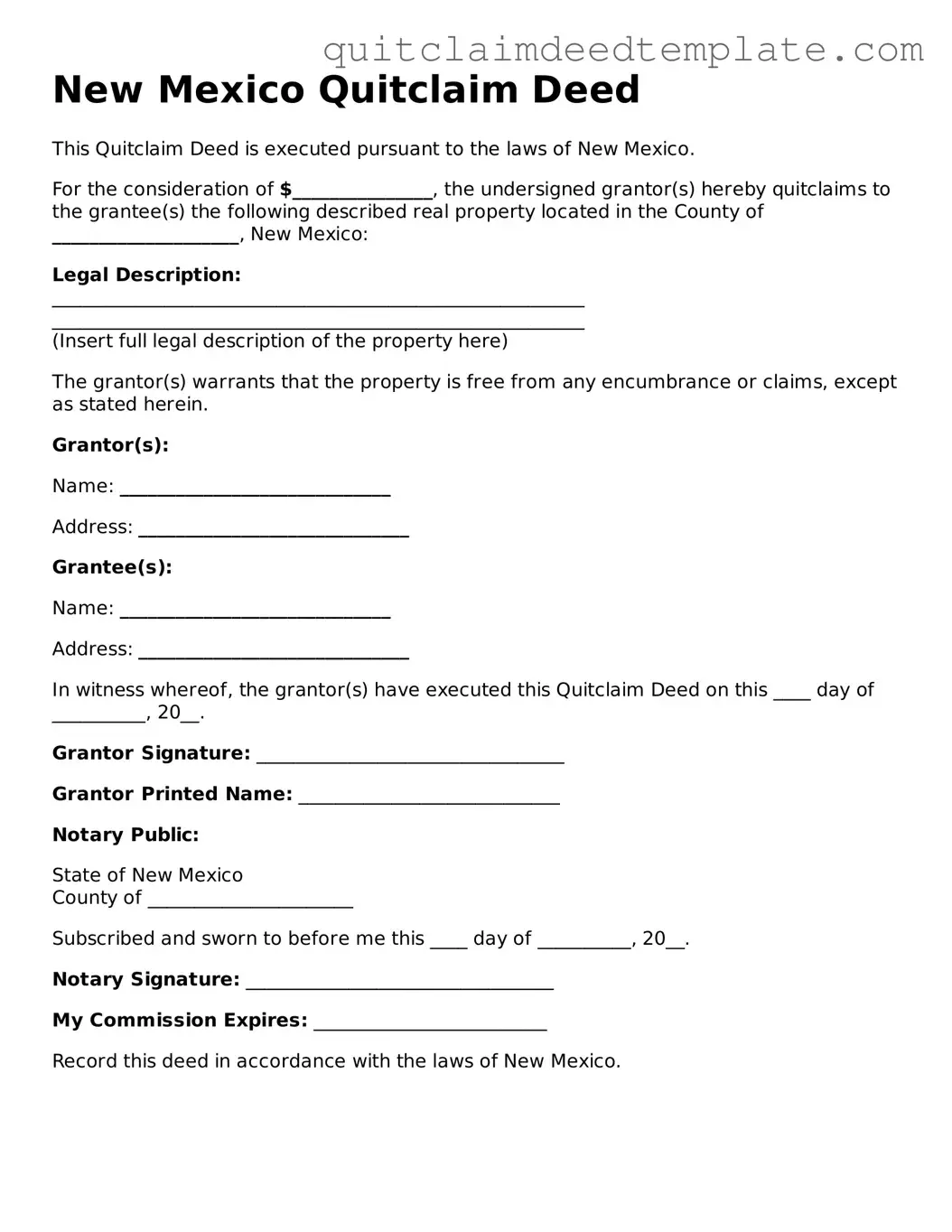

A Quitclaim Deed must include specific information to be valid. This includes the names of the grantor and grantee, a legal description of the property, the date of the transfer, and the signature of the grantor. It is also advisable to include the property’s address for clarity. The deed must be notarized to ensure its legal validity.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is highly recommended. An attorney can ensure that all necessary information is included and that the deed complies with state laws. This can help avoid potential disputes or issues in the future regarding the property transfer.

How do I file a Quitclaim Deed in New Mexico?

To file a Quitclaim Deed in New Mexico, you must first complete the deed form with all required information. After signing the document in the presence of a notary, you will need to file it with the county clerk’s office in the county where the property is located. There may be a filing fee, so it’s wise to check with the local office beforehand.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides guarantees from the grantor that they hold clear title to the property and that there are no undisclosed encumbrances. In contrast, a Quitclaim Deed transfers whatever interest the grantor has in the property without any such guarantees, making it a riskier option for the grantee.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. However, if both parties agree, they can execute a new deed to reverse the transfer. This process would typically involve creating another Quitclaim Deed or a Warranty Deed to restore ownership to the original grantor.

Are there tax implications when using a Quitclaim Deed?

Yes, there may be tax implications when transferring property via a Quitclaim Deed. While many family transfers may qualify for exemptions, it is essential to consult with a tax professional to understand potential capital gains taxes or other implications that may arise from the transfer.

What happens if the grantor has debts?

If the grantor has debts, those debts may still be attached to the property even after a Quitclaim Deed is executed. This means that creditors could potentially place liens on the property. It is crucial for the grantee to be aware of any existing liens or encumbrances before accepting a Quitclaim Deed.

Can a Quitclaim Deed be used to transfer property into a trust?

Yes, a Quitclaim Deed can be used to transfer property into a trust. This is often done as part of estate planning. The grantor can transfer their property to the trust, allowing for easier management and distribution of the property upon their passing. It is advisable to consult with an estate planning attorney to ensure the transfer aligns with the trust’s terms and state laws.