What is a Nebraska Quitclaim Deed?

A Nebraska Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees regarding the property title. This means that the person transferring the property, known as the grantor, does not assure the recipient, or grantee, that the title is free of claims or encumbrances. Quitclaim deeds are often used among family members or in situations where the parties know each other well and trust the transaction.

When should I use a Quitclaim Deed in Nebraska?

Individuals typically use a Quitclaim Deed in several scenarios. Common situations include transferring property between family members, such as when parents gift property to their children, or during divorce proceedings when one spouse relinquishes their interest in a property to the other. It can also be used to clear up title issues, such as when a property owner wants to remove an ex-spouse or a deceased person's name from the title.

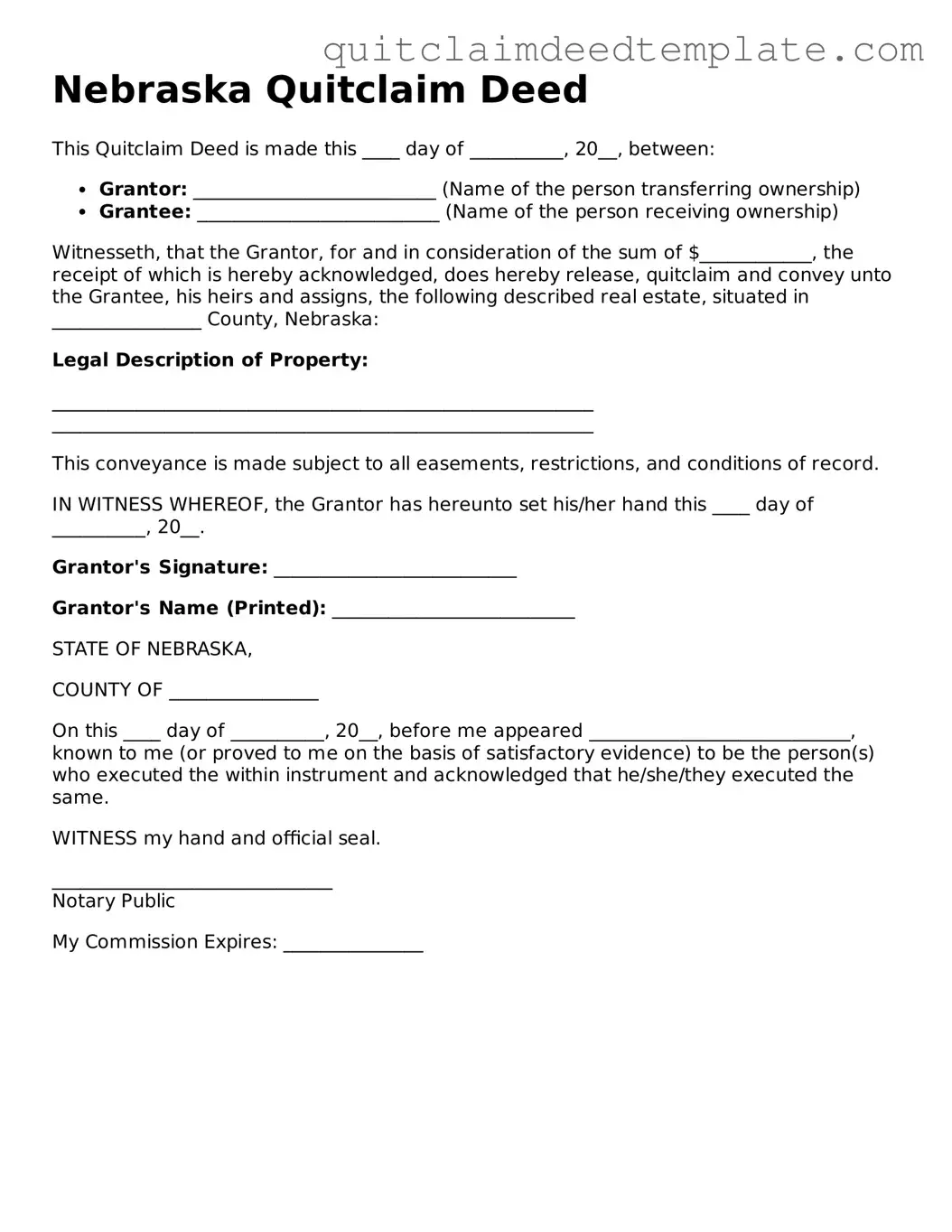

What information is required on a Nebraska Quitclaim Deed?

A Nebraska Quitclaim Deed must include specific information to be valid. This includes the names and addresses of the grantor and grantee, a legal description of the property being transferred, and the date of the transfer. Additionally, the deed should be signed by the grantor in the presence of a notary public. It is also advisable to include a statement indicating that the grantor is conveying their interest in the property, even if that interest is unclear.

Do I need to record a Quitclaim Deed in Nebraska?

Recording a Quitclaim Deed is not mandatory in Nebraska, but it is highly recommended. Recording the deed with the county register of deeds provides public notice of the transfer and helps establish the grantee's ownership rights. Failure to record may lead to complications, especially if the property is sold again or if disputes arise regarding ownership. Once recorded, the Quitclaim Deed becomes part of the public record.

Are there any fees associated with filing a Quitclaim Deed in Nebraska?

Yes, there are typically fees associated with recording a Quitclaim Deed in Nebraska. These fees can vary by county, so it is advisable to check with the local register of deeds office for specific amounts. In addition to the recording fee, there may also be costs related to obtaining a notary signature or any legal advice you might seek during the process.

Can a Quitclaim Deed be contested in Nebraska?

Yes, a Quitclaim Deed can be contested in Nebraska, although doing so may be challenging. If a party believes the deed was executed under duress, fraud, or without the grantor's consent, they may have grounds to contest it. Additionally, if there are disputes regarding the property title, such as claims from third parties, those issues may also lead to legal challenges. It is advisable for anyone considering contesting a Quitclaim Deed to consult with a legal professional to understand their options and potential outcomes.