What is a Montana Quitclaim Deed?

A Montana Quitclaim Deed is a legal document that allows a property owner to transfer their interest in a property to another party without guaranteeing that the title is clear. This type of deed is often used between family members or in situations where the parties know each other well. It is important to note that a quitclaim deed does not provide any warranty regarding the property’s title, meaning the grantee takes on the property “as is.”

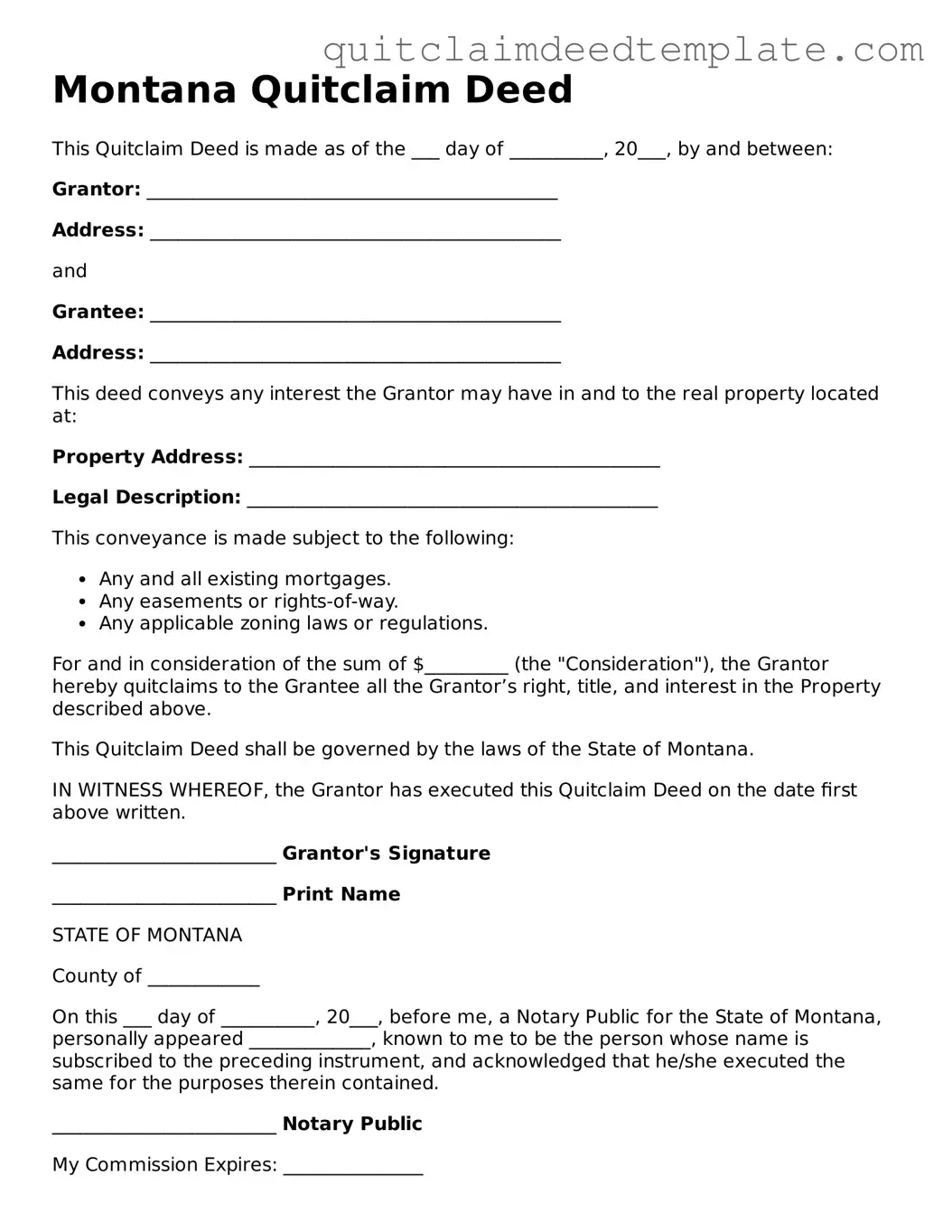

How do I fill out a Montana Quitclaim Deed?

To fill out a Montana Quitclaim Deed, start by entering the names and addresses of both the grantor (the person transferring the property) and the grantee (the person receiving the property). Next, provide a legal description of the property being transferred. This can often be found in previous deeds or property tax records. Finally, both parties should sign the document in front of a notary public. Ensure that all information is accurate to avoid future disputes.

Do I need to have the Quitclaim Deed notarized?

Yes, in Montana, a Quitclaim Deed must be notarized to be considered valid. The signatures of both the grantor and the grantee should be witnessed by a notary public. This step adds an extra layer of authenticity and helps prevent fraud.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed does not offer any such guarantees. The grantee accepts whatever interest the grantor has, which may be limited or even non-existent.

What are the tax implications of using a Quitclaim Deed in Montana?

Generally, transferring property via a Quitclaim Deed may trigger tax implications, including property transfer taxes. However, certain transfers, such as those between family members, may qualify for exemptions. It is advisable to consult with a tax professional to understand the specific tax consequences related to your situation.

Can a Quitclaim Deed be revoked in Montana?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. However, the grantor can create a new deed to reverse the transfer, but this would require the consent of the grantee. It’s essential to consider the implications of such actions before proceeding.

How do I record a Quitclaim Deed in Montana?

To record a Quitclaim Deed in Montana, take the completed and notarized deed to the local county clerk and recorder’s office where the property is located. There may be a small fee for recording the document. Once recorded, the deed becomes part of the public record, providing official notice of the transfer.

What happens after I file a Quitclaim Deed?

After filing a Quitclaim Deed, the new owner’s name will be added to the property records. This establishes their legal interest in the property. It is advisable for the grantee to keep a copy of the recorded deed for their records. Additionally, the property tax records may need to be updated to reflect the new ownership.

Can I use a Quitclaim Deed to transfer property to a trust?

Yes, a Quitclaim Deed can be used to transfer property into a trust. This is a common practice for estate planning purposes. When doing so, it is important to ensure that the trust is properly established and that the deed is executed correctly to avoid any legal complications.