Documents used along the form

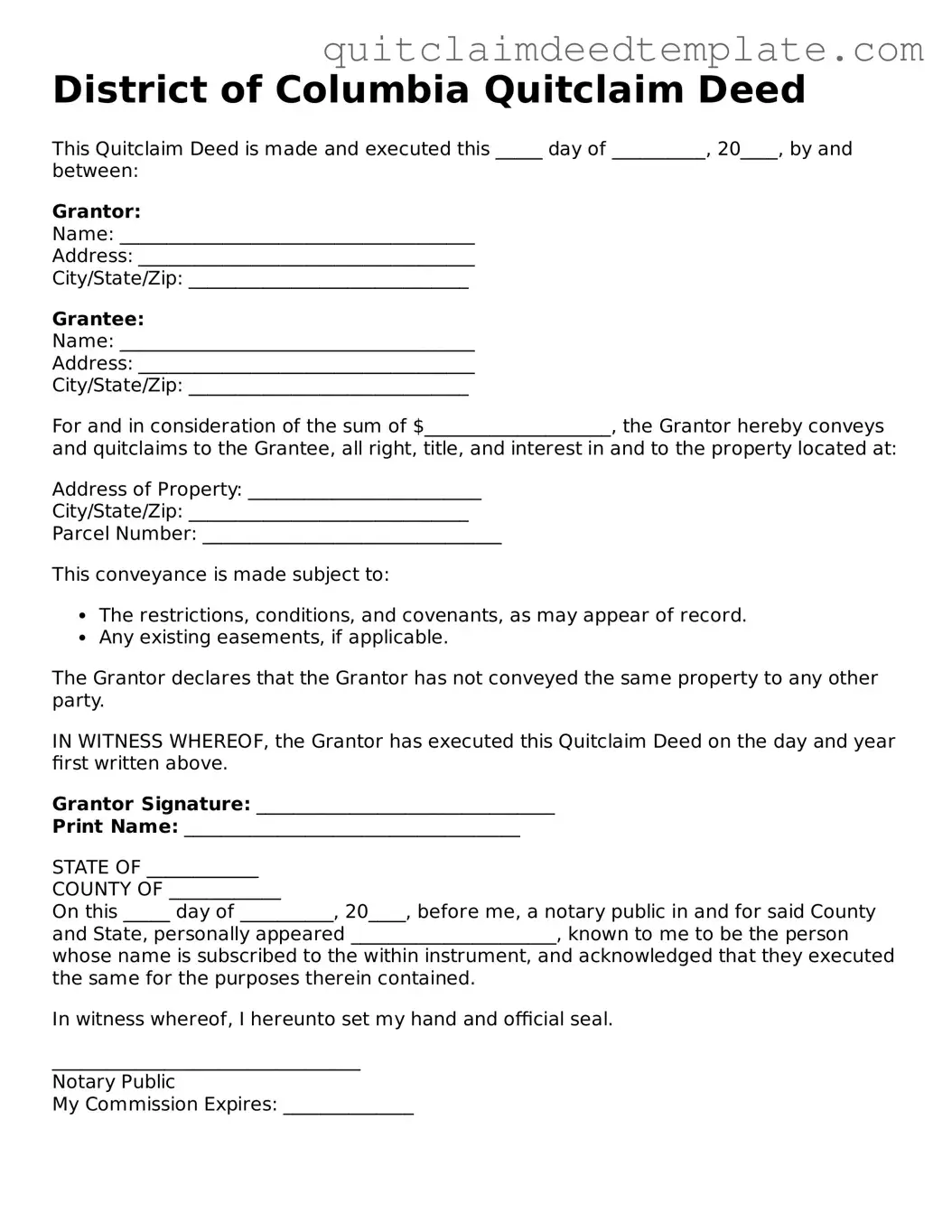

When dealing with property transfers in the District of Columbia, the Quitclaim Deed form is a crucial document. However, it is often accompanied by other forms and documents that help clarify the transaction and ensure that all legal requirements are met. Here are four commonly used documents that complement the Quitclaim Deed:

- Property Transfer Tax Form: This form is required to report the transfer of property and calculate any applicable taxes. It ensures that the local government is informed about the change in ownership.

- Affidavit of Value: This document provides a sworn statement regarding the value of the property being transferred. It can help establish the fair market value for tax purposes and is often required for recording the deed.

- Title Search Report: A title search report outlines the history of the property’s ownership and any existing liens or encumbrances. This document is essential for verifying that the seller has the legal right to transfer the property.

- Settlement Statement: Also known as the HUD-1 form, this document details all financial aspects of the property transaction, including fees and payments. It provides transparency for both the buyer and seller about the costs involved in the transfer.

Each of these documents plays a vital role in ensuring a smooth property transaction in the District of Columbia. They help protect the interests of both parties and provide necessary information to local authorities. Being prepared with these forms can streamline the process and minimize potential issues down the line.