What is a Quitclaim Deed in Alabama?

A Quitclaim Deed is a legal document used to transfer ownership of real property in Alabama. It allows one party, known as the grantor, to convey their interest in a property to another party, referred to as the grantee. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the grantor has clear title to the property, nor does it provide any warranties regarding the property’s condition or title status.

When should I use a Quitclaim Deed?

Quitclaim Deeds are commonly used in situations such as transferring property between family members, adding or removing a spouse from the title after marriage or divorce, or when a property owner wants to clarify ownership without selling the property. They are also used in situations where the grantor is unsure of their title status.

What information is required on a Quitclaim Deed?

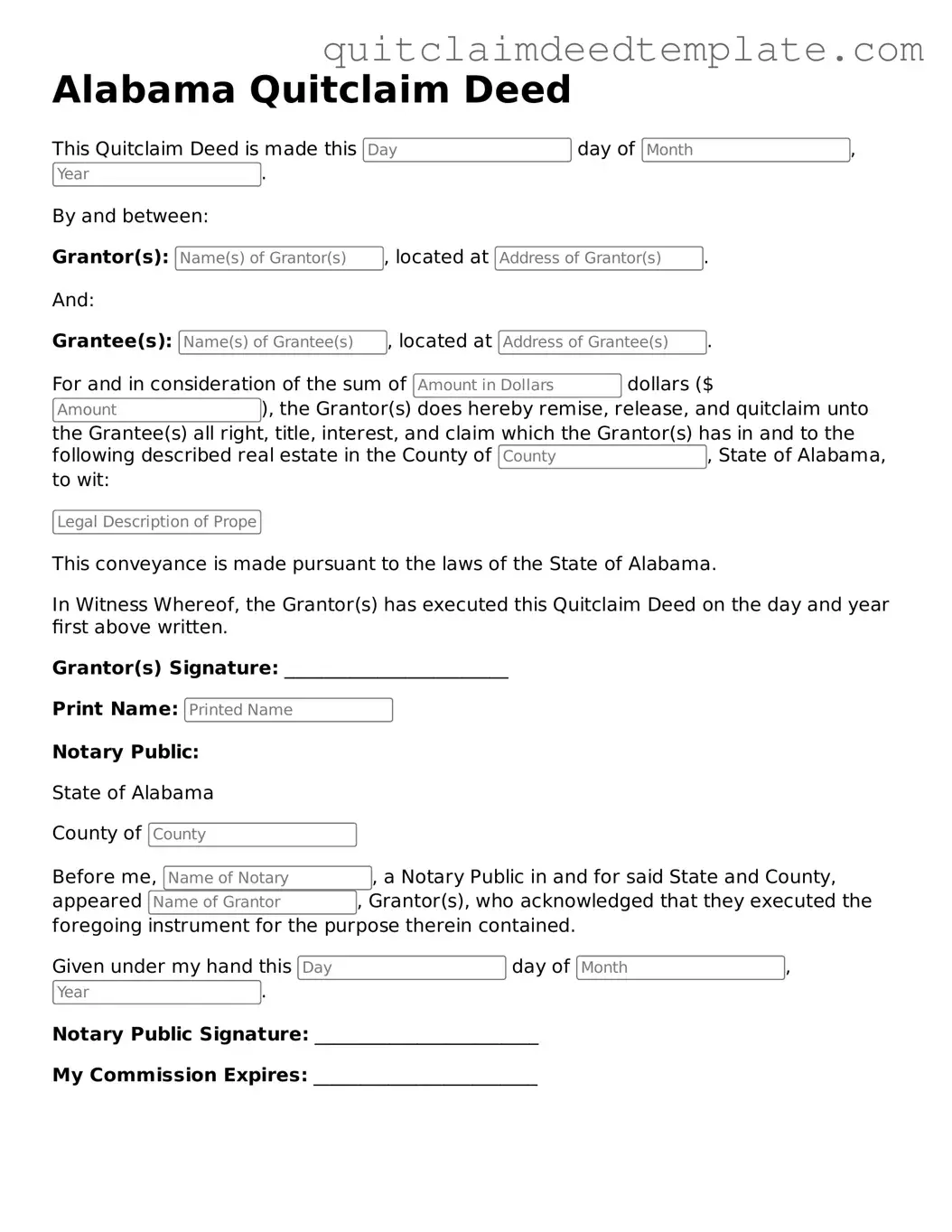

A Quitclaim Deed in Alabama typically requires the following information: the names and addresses of the grantor and grantee, a legal description of the property, the date of the transfer, and the signature of the grantor. It is also advisable to include the consideration, or the value exchanged for the transfer, even if it is nominal.

Is notarization required for a Quitclaim Deed?

Yes, a Quitclaim Deed must be notarized in Alabama. The grantor must sign the document in the presence of a notary public, who will then affix their seal to the document. This step helps to verify the identity of the grantor and the authenticity of the signature.

How do I file a Quitclaim Deed in Alabama?

After completing the Quitclaim Deed, it must be filed with the appropriate county probate court or the county’s land records office where the property is located. There may be a filing fee associated with this process. It is important to check with the local office for specific requirements and fees.

What are the tax implications of using a Quitclaim Deed?

In Alabama, transferring property through a Quitclaim Deed may have tax implications, including potential property tax reassessments. While there may not be a transfer tax for the deed itself, it is advisable to consult a tax professional to understand any potential liabilities or benefits associated with the transfer.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and filed, it cannot be unilaterally revoked by the grantor. However, the grantor and grantee can agree to a new deed that reverses the transfer. This would typically involve creating a new Quitclaim Deed that transfers the property back to the original owner.

What is the difference between a Quitclaim Deed and a Warranty Deed?

The primary difference lies in the warranties provided. A Warranty Deed guarantees that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed transfers whatever interest the grantor has without any guarantees or warranties regarding the title. This makes Quitclaim Deeds riskier for the grantee.

Do I need an attorney to prepare a Quitclaim Deed?

While it is not legally required to have an attorney prepare a Quitclaim Deed, it is often recommended, especially if the transaction is complex or if there are concerns about title issues. An attorney can provide guidance and ensure that all necessary information is included and that the deed complies with Alabama laws.

How long does it take for a Quitclaim Deed to be processed?

The processing time for a Quitclaim Deed can vary depending on the county and the volume of documents being filed. Generally, once filed, the deed is recorded in the public records, and this process can take anywhere from a few days to several weeks. It is advisable to follow up with the local office to confirm the status of the filing.